5 years already... Performances, overview and outlook

Our SRI thematic funds Sycomore Happy@Work and Sycomore Eco Solutions celebrate their 5th anniversary.

Dear clients,

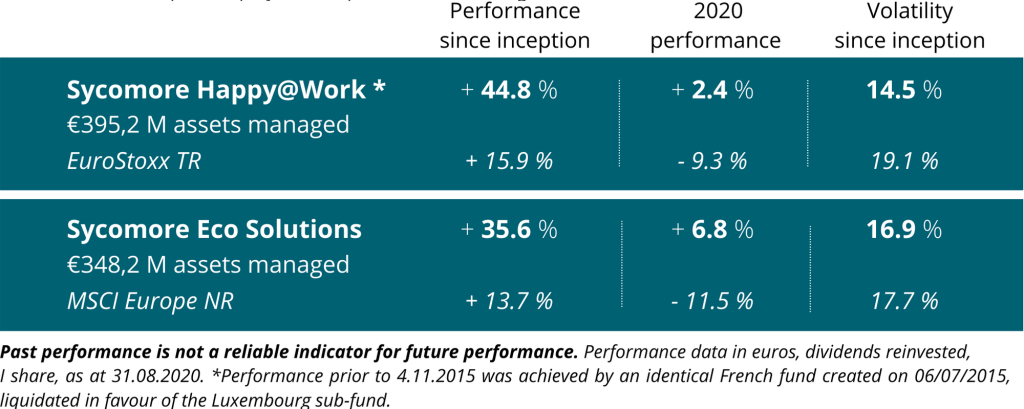

We are delighted to mark the 5th anniversary of our Sycomore Happy@Work and Sycomore Eco Solutions funds. Launched in 2015, these two SRI-labelled funds embody our strongest conviction: that investing in responsible investment themes will enable us to combine purpose and performance and achieve your long-term financial goals.

While Sycomore Happy@Work invests in companies that have chosen to focus on the well-being of their employees as a key feature of their corporate strategy, Sycomore Eco Solutions selects innovative and eco-efficient companies which, we believe, are contributing to the environmental and energy transition. Five years later, how did these strategies perform?

Our convictions have played out

INVESTMENT THEMES THAT REMAIN AS RELEVANT AS EVER

Never before have companies, investors, governments and public opinion shown this much interest in social and environmental issues. This justifies a long-term positioning.

While human capital is usually considered to be an advantage that will drive a company’s competitiveness, the health crisis has now turned employees into indispensable assets. Looking at stock market prices, the performance gap between so-called “happy” companies and those that have not payed enough attention to their human capital has indeed widened in recent months.

An example within the e-commerce industry: Zalando, which has successfully improved its staff engagement these past few years, was able to maintain its operations during the lockdown and gain market share. The company’s stock price has surged by 62% since the beginning of the year. Boohoo, on the other hand, which has been accused of over-exploiting its production chain workers in order to keep its margins high, lost 3%.

We also expect the environmental transition to be boosted by a durable positive momentum, particularly as civil society has now become a driving force.

Environment-related issues feature extensively in the Covid Recovery Funds: in Europe, 25% of the 1,850 billion-euro budget will fund the acceleration of the environmental transition, with capital channeled to several priority sectors (home renovation, incentives for the purchase of electric vehicles, development of renewable energies, rail infrastructure, circular economy etc.). The environment is also likely to be a central focus for the French government’s 100 billion euro-recovery plan. And in the United States, Joe Biden, currently leading the polls, unveiled an ambitious 2 trillion-dollar plan for renewable energies…

Green energies have also become increasingly competitive. For example, the Alfen group, which has posted excellent stock market returns year-to-date (+230%), has recently published even better-than-expected first half earnings, driven by long-term trends that are particularly favourable for its three main businesses: smart grids, charging stations for electric vehicles and energy storage.

Feel free to contact our sales teams who will be happy to discuss these topics in more depth!

''Disclaimer: The performance of the funds and companies mentioned may partly stem from ESG indicators on portfolio holdings although these may not play a decisive part in performance trends. The funds do not guarantee returns or performance and might entail capital loss. Before investing, please consult the Key Investor Information Documents (KIID) which are available on our site www.sycomore-am.com.''

Risk level

Sycomore Happy@Work - I share

Sycomore Eco Solutions - I share

''The chart opposite reflects the fund's exposure to all caps equity markets in the European Union. The fund’s risk category is not guaranteed and may change over time. The lowest category does not mean "risk free". Historic data used to calculate the synthetic indicator may not represent a reliable indication of the fund’s future risk.''