A bright future still lies ahead for Tech

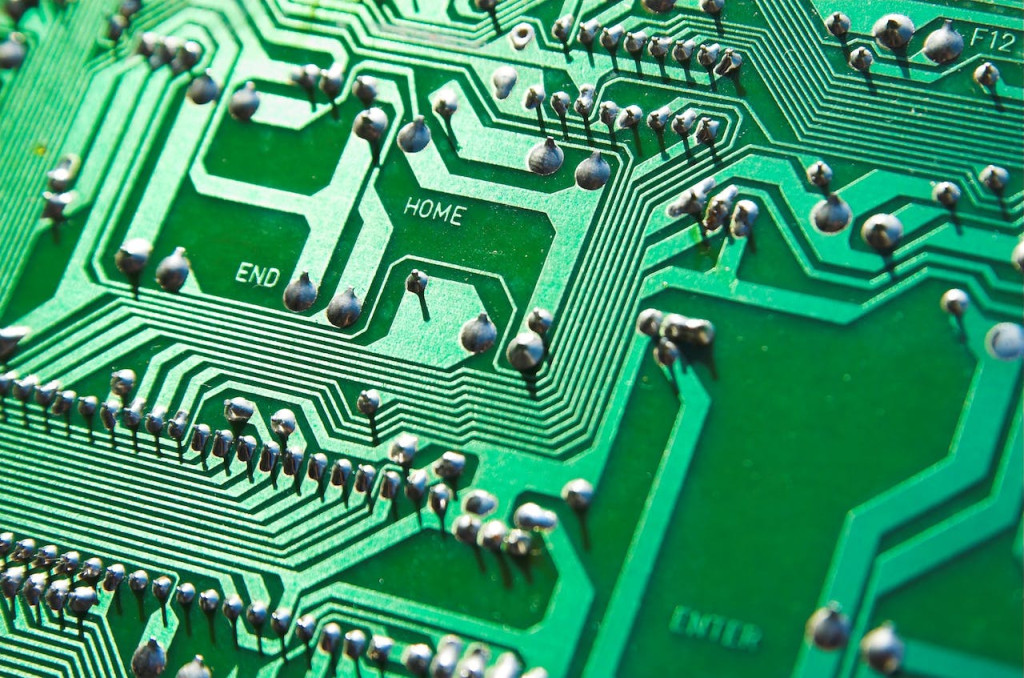

The rapid pace of AI development is creating investment opportunities, notably with the semiconductor value chain. The normalization of IT spending is also a major catalyst.

Sam Altman, the founder of ChatGPT, is reportedly seeking to raise 7,000 billion dollars to overhaul the global semiconductor industry. The CEO of OpenAI - which owns the generative artificial intelligence software - is planning to address the shortage of chips, which are crucial for advancing the growth of AI.

He has mentioned setting up an entire network of fabrication plants to overcome shortages that would hinder the future growth of an entire industry. The energy deployed by Sam Altman demonstrates the vital importance of the semiconductor value chain in supporting and driving growth for tech players. The latter clearly intend to prepare the ground and secure their growth for the years to come.

Optimism prevails

Thanks to the revolution of AI and other technologies, we are positive on the outlook for the sector. After a strong year for Tech stocks in 2023, driven mostly by the “Magnificent Seven”*, valuations within the sector are now indeed above their historical average. However, we feel the sector stands to benefit from substantial upward revisions to earnings forecasts for 2024 and 2025, supported by a normalization of corporate IT budgets.

Over the longer run, we also expect this optimism to prevail. The world is making fast strides in digitalization and the trend will only accelerate over the next few years. By 2030, around 30% of the world’s GDP could be derived from digital goods and services**. The astronomic quantity of data these digital goods and services will generate will require significant compute and data storage capacity, fueling demand for digital infrastructure companies. Cloud providers, the semiconductor value chain, and infrastructure software companies that will support an exponential increase in storage capacity and IT processing, are likely to be the winners.

Some companies are in a strong position

Within the semiconductor value chain, equipment manufacturers are well positioned to benefit from the growth of AI. These include ASML, one of the world’s leading suppliers of lithography machines for the semiconductor industry. ASML is strong from an ESG perspective as well. Not only does the company help to improve energy efficiency within the industry, but the modular design of its products also extends their lifetime. Almost 95% of the lithography systems sold by ASML, across the range, are still active in chip making facilities, underlining the company’s role in supporting a sustainable economy.

Micron, a US memories manufacturer, should also benefit from a positive momentum. We believe that the memory cycle is poised for substantial growth in 2024 and 2025, leaving plenty of room for upward revisions to consensus earnings estimates. Furthermore, demand for new generation HBM-high bandwidth memory chips, fueled by the adoption of AI, is an important catalyst for Micron.

Finally, HashiCorp, a small cap software company based in California that develops products that enable and secure the deployment of multi cloud computing infrastructure seems particularly well positioned. The stock is trading at a very attractive valuation after suffering

greatly from the major cuts to IT spending in 2022 and 2023. The normalization we expect in 2024 and 2025 should enable HashiCorp to re-accelerate growth.

*US Tech Giants: Nvidia, Meta, Tesla, Apple, Microsoft, Alphabet and Amazon.

**Source: Digital Cooperation Organization (DCO). February 2023.

Written by the investment team of Sycomore Sustainable Tech (David Rainville, Luca Fasan and Marie Vallaeys)

The opinions and estimates herein are based on our judgement and may change without prior warning as may assertions on financial market trends which are based on current market conditions. To the best of our knowledge, the information herein is reliable but must not be considered as exhaustive. This document is not an offer or a solicitation to buy or sell any financial instrument whatsoever. References to specific securities or their issuing companies are merely for illustrative purposes and should not be construed as recommendations to buy or sell these securities.

Past performance is not a reliable indicator of future returns. Opinions and strategies described may not be suitable for all investors. Returns and valuations for investments in any funds that might be mentioned may rise or fall and investors may receive more or less at redemption than the sum initially invested. Investors are warned that they could suffer capital losses.