Sycomore Sustainable Tech gets off to a strong start in 2024

Sycomore Sustainable Tech has posted healthy performances since the beginning of the year. Since January 1st, the Sycomore Sustainable Tech fund has returned +6.7% versus 5.3% for its benchmark, the MSCI ACWI Information Technology index. Over 12 months, the fund is up +42%, versus 41.7% for the benchmark*. In this interview, the investment team (David Rainville, Luca Fasan and Marie Vallaeys) discuss the fund’s performance and their outlook for the tech sector. They also share some of their interesting investment convictions for 2024– focusing specifically out of the FANGs, preferring smaller and medium capitalization businesses!

What are your thoughts on the fund’s strong run?

Our team has built a thorough and Tech-specific financial and extra-financial analysis process that is designed to build a long-term conviction technology investment portfolio. Our diversified multi-thematic portfolio, which excludes the FANGs, has been particularly successful over the past year. We focus on stocks we view as offering the best risk-adjusted upside when considering both financial and sustainability risks over the medium and long-term. We have positioned the to benefit from key digitalization themes such as: new ways of working, digitalization within industries such as construction, artificial intelligence, and cybersecurity.

In order to direct our investments towards the most sustainable businesses, we rely on a Responsible Tech Framework, which acts as a valuable compass for our team. Furthermore, we actively engage with companies within the sector to encourage the adoption of best-practices in the field.

How confident are you for the months and years to come?

After a strong year for Tech stocks in 2023, driven mostly by the “Magnificent Seven”**, valuations within the sector are now indeed above their historical average. However, we believe the sector stands to benefit from substantial upward revisions to earnings forecasts for 2024 and 2025, supported by a normalization of corporate IT budgets. Specifically, we note that in previous positive earnings revision cycles for tech, multiple accretion did not drive equity returns for the sector, and that instead the strong growth in the sector’s fundamentals generated most of the price appreciation for these stocks.

Over the longer run we also expect this optimism to prevail. The world is making fast strides in digitalization and the trend will only accelerate over the next few years. By 2030, around 30% of the world’s GDP could be derived from digital goods and services3, up from 15% last year creating a significant investment opportunity.

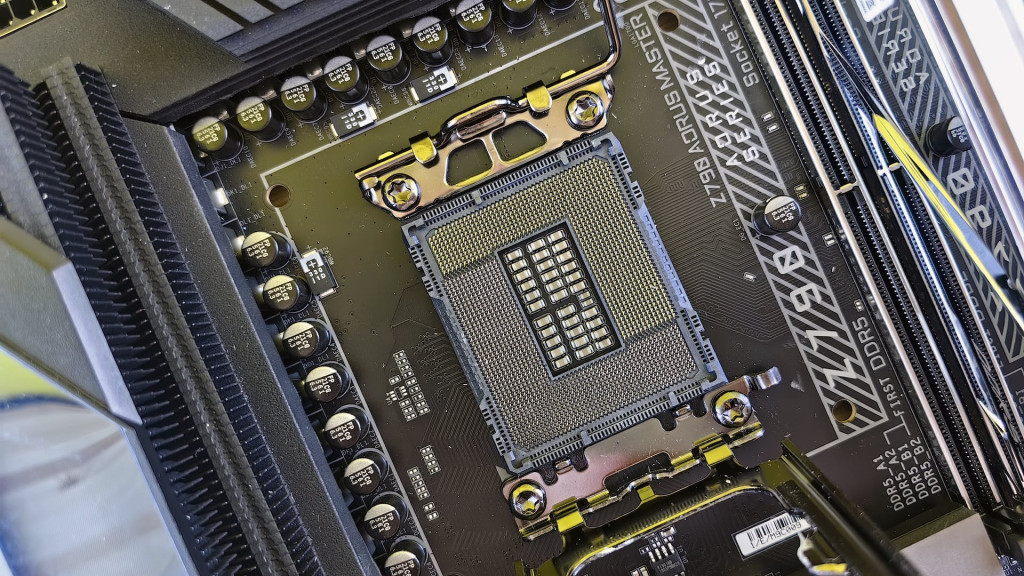

The astronomic quantity of data these digital goods and services will generate will require significant compute and data storage capacity. To power these applications, we expect significant investments in digital infrastructure companies – which are a significant part of the

Sycomore Sustainable Tech portfolio. The investment team is particularly upbeat on cloud providers, the semiconductor value chain, and infrastructure software companies that will support an exponential increase in storage capacity and IT processing.

Could you give us three examples of companies held in the portfolio?

The first would be HashiCorp, a small cap software company based in California. HashiCorp develops products that enable and secure the deployment of multi cloud computing infrastructure. We particularly like this stock, which is trading at a very attractive valuation after suffering greatly from the major cuts to IT spending in 2022 and 2023. The normalization we expect in 2024 and 2025 should enable HashiCorp to re-accelerate growth.

Micron, a US memories manufacturer, is also one of our top convictions for this year. We believe that the memory cycle is poised for substantial growth in 2024 and 2025, leaving plenty of room for upward revisions to consensus earnings estimates. Furthermore, demand for new generation HBM-high bandwidth memory chips, fueled by the adoption of AI, is an important catalyst for Micron in addition to the normalization of the cycle.

Within the semiconductor value chain, equipment manufacturers are also well positioned to benefit from this growth. Examples include ASML, one of the world’s leading suppliers of lithography machines for the semiconductor industry. ASML is one of our favorite stocks from an ESG perspective as well. Not only does the company help to improve energy efficiency within the industry, but the modular design of its products also extends their lifetime. Almost 95% of the lithography systems sold by ASML, across the range, are still active in chip making facilities, underlining the company’s role in supporting a sustainable economy.

*Data as of 31/01/2024. IC share class. Source: FactSet; Sycomore Asset Management. Past performance is no guide to future returns. Please note that the investment team changed on January 2nd, 2023.

**US Tech Giants: Nvidia, Meta, Tesla, Apple, Microsoft, Alphabet and Amazon.

***Source: Digital Cooperation Organization (DCO). February 2023.

Data as of 29/01/2024. The opinions and estimates herein are based on our judgement and may change without prior warning as may assertions on financial market trends which are based on current market conditions. To the best of our knowledge, the information herein is reliable but must not be considered as exhaustive. This document is not an offer or a solicitation to buy or sell any financial instrument whatsoever. References to specific securities or their issuing companies are merely for illustrative purposes and should not be construed as recommendations to buy or sell these securities. Past performance is not a reliable indicator of future returns. Opinions and strategies described may not be suitable for all investors. Returns and valuations for investments in any funds that might be mentioned may rise or fall and investors may receive more or less at redemption than the sum initially invested. Investors are warned that they could suffer capital losses.